Back Testing Algorithmic Trading Modern Portfolio Simulator

| Previous Post | Next Post |

|---|

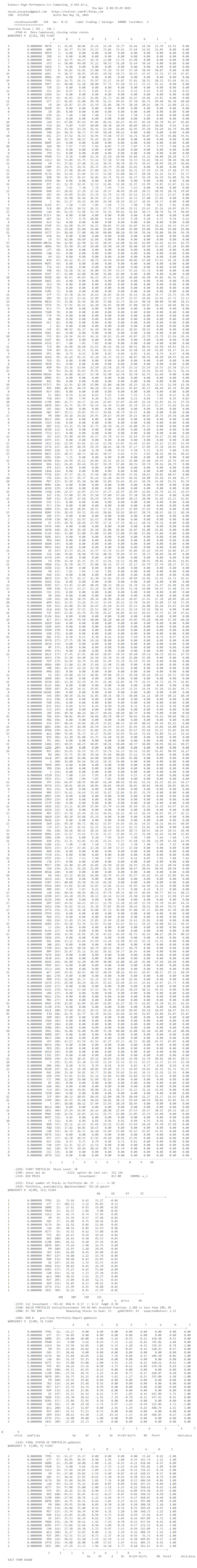

2 |ExSan| C++ |ExSan| MSVSC2022_V17_6.3@06.16-toolSet(v143)-

3 Sat Jun 24 10:07:24 2023

4

5

6 exsan.plusplus@gmail.com https://twitter.com/#!/ExSan_com

7 JOB: hft_0724

8

9 Clock now: 3285752562408800 nanoseconds since boot

10 GLUTo Mon Jan 1, 2024

11 License Grant for: 165 days more

12 DBfile: stockDB_8.txt dbfileID: 4

13 StockCounterDB Number of files: 42

14

16 :409: 1 dbfileID: 7 stockDB15.txt

17 :410: 2 nTickRead: 99999

18 :411: 3 cols: 7

19 :416: 7 minDB: 2

20 Read From File myInvestment: 10049 Savings: 124

21

22 pp_lastIN 0 ppnt_time 1 ppnt_data 2

23 stockCounterDB: 42 mu: 0.33 Limit Trading / Savings: 10000 FactoRun: 2

24 ******************

25 <--------e-x-s-a-n---------->

26 Generate Exsan ( 43 , 44 )

27

28 Total Number of assets allocated: 42

29

30 PARAMETERS

31 Investment: 10049 min Inv/Stock: 50 # Ticks -cols-: 7 beta: 0.02 ep(little ball): 0.0001

32 HedgeBand 0.15055 <-- nbsp=""> 0.84945 R( 0.34013 ; 0.45013 )r Lineal #Ticks: 3

33 Expected Return: 2.7 % minDB: 2 timesLapse: 3 timeZoomFactor: 1 retFactor: 0.1

34 Check Trigger Counter: 4 Number of times dice is thrown: 99999 EndLess: 0

35 Run: 3 onlyInteger 0 hedge: 1 ntNodes: 1 limitWeightFactor: 0.33 tickLimitToClear: 33

37 |<--------e-x-s-a-n---hft------->|

7852

7853

7854 :3192: PORTFOLIO Selected Stocks ppDB

7855 WORKSHEET 4 D[25, 7] FLOAT

7856 A B C D E F G

7857 >-------------------------------------------------<

7858 11 44782457.14 BRLC 1: 18.00 17.90 17.84 17.80 17.76 17.90 17.64

7859 20 41668828.57 ATLU 2: 32.43 32.79 33.63 34.33 34.38 34.03 33.49

7860 12 37445457.14 BGG 5: 10.83 10.69 10.63 10.97 11.34 11.35 11.18

7861 19 51127500.00 BBY 6: 34.79 37.07 37.07 36.27 36.52 36.11 35.93

7862 31 3744685.71 AAPL 12: 80.35 78.09 74.85 78.67 78.49 75.80 73.93

7863 20 29326342.86 BMY 14: 26.22 26.47 25.93 25.44 25.63 25.38 25.76

7864 22 19499771.43 BOOM 17: 15.85 15.80 15.81 15.36 15.47 15.75 15.38

7865 16 63605585.71 ABMD 23: 17.98 18.20 17.75 17.90 18.09 18.02 17.89

7866 14 58732728.57 AMCSA 24: 39.04 39.37 39.17 38.04 38.05 38.88 39.60

7867 16 61438714.29 ARAC 25: 10.72 10.60 9.97 9.95 9.92 9.78 9.76

7868 <------------------------------------------------->

7869 1 2 3 4 5 6 7

7870

7871 :3266: NORMALIZED-SCALED Adding Up Weights: +Sum:0.76696440 -Sum: 0.00000000 +Sum - -Sum: 0.76696440

7872 :3275: end normalizar el output °°° Adding Up Weights sum: 0.00000000 +Sum:0.76696440

7873 -Sum: 0.00000000 +Sum - -Sum: 0.76696440 last col W, previous N

7874 :3300: -----------------------------------------------

7875 :3301: HEDGING (hdplus/hdsum) Ok! In range 0.15055000 < 0.19231006 < 0.84945000 hdplus: 0.14749497 hdminus: 0

7876 :3362: Adding Up Weights: 0.00000000 +Sum:0.76696440 -Sum: 0.00000000 +Sum - -Sum: 0.76696440 last col W,

7877 :3216: run: 3 counter: 3

7878 :3454: Total number of Stocks in Portfolio db: 0 <---- nbsp=""> 2 abSum => 0.77629776 updated myInvestment: 1004

7879 :3500: deltaPrice = myInvestment - portfolioInvestment: 10049.00 - 7800.94 = 2248.06

7880 :3501: Before if - Stock counter: 0 <---> 2 <-: mindb="" nbsp="" p="">

7881 :3502: Not invested fraction %deltaPrice: 2248.06/ 10049.00 = -0.2237100

7882

7883

7884 :3192: PORTFOLIO Selected Stocks ppDB

7885 WORKSHEET 4 D[23, 7] FLOAT

7886 A B C D E F G

7887 >-------------------------------------------------<

7888 19 9428542.86 ATSG 5: 8.10 7.81 7.66 7.60 7.73 7.69 7.87

7889 10 9414614.29 ANRA 23: 16.10 16.70 16.80 17.40 17.10 17.30 16.30

7890 <------------------------------------------------->

7891 1 2 3 4 5 6 7

7892

7893 :3266: NORMALIZED-SCALED Adding Up Weights: +Sum:0.90196121 -Sum: 0.00000000 +Sum - -Sum: 0.90196121

7894 :3275: end normalizar el output °°° Adding Up Weights sum: 0.00000000 +Sum:0.90196121

7895 -Sum: 0.00000000 +Sum - -Sum: 0.90196121 last col W, previous N

7896 :3300: -----------------------------------------------

7897 :3301: HEDGING (hdplus/hdsum) Ok! In range 0.15055000 < 0.76005892 < 0.84945000 hdplus: 0.68554366 hdminus: 0

7898 :3362: Adding Up Weights: 0.00000000 +Sum:0.90196121 -Sum: 0.00000000 +Sum - -Sum: 0.90196121 last col W,

7899 :3216: run: 3 counter: 2

7900 :3454: Total number of Stocks in Portfolio db: 0 <---- nbsp=""> 2 abSum => 0.76005892 updated myInvestment: 1004

7901 :3500: deltaPrice = myInvestment - portfolioInvestment: 10049.00 - 7637.76 = 2411.24

7902 :3501: Before if - Stock counter: 0 <---> 2 <-: mindb="" nbsp="" p="">

7903 :3502: Not invested fraction %deltaPrice: 2411.24/ 10049.00 = -0.2399487

7904

7905

7906 :3192: PORTFOLIO Selected Stocks ppDB

7907 WORKSHEET 4 D[20, 7] FLOAT

7908 A B C D E F G

7909 >-------------------------------------------------<

7910 9 5003785.71 BGG 4: 10.94 11.09 11.51 11.50 11.54 11.96 11.77

7911 11 4949714.29 ASCMA 8: 19.34 19.82 19.66 19.85 18.86 18.15 17.79

7912 13 2910457.14 AAL 19: 15.55 15.02 15.77 15.91 15.51 15.43 14.95

7913 12 5363942.86 BHI 20: 32.50 32.94 32.65 32.60 32.40 33.07 33.46

7914 <------------------------------------------------->

7915 1 2 3 4 5 6 7

7916

7917 :3266: NORMALIZED-SCALED Adding Up Weights: +Sum:0.73618048 -Sum: -0.00118777 +Sum - -Sum: 0.73736825

7918 :3275: end normalizar el output °°° Adding Up Weights sum: 0.00000000 +Sum:0.73618048

7919 -Sum: -0.00118777 +Sum - -Sum: 0.73736825 last col W, previous N

7920 :3300: -----------------------------------------------

7921 :3301: HEDGING (hdplus/hdsum) Ok! In range 0.15055000 < 0.76307448 < 0.84945000 hdplus: 0.56266690 hdminus: 0

7922 :3362: Adding Up Weights: 0.00000000 +Sum:0.73618048 -Sum: -0.00118777 +Sum - -Sum: 0.73736825 last col W

7923 :3216: run: 3 counter: 3

7924 :3454: Total number of Stocks in Portfolio db: 0 <---- nbsp=""> 2 abSum => 0.76146365 updated myInvestment: 1004

7925 :3500: deltaPrice = myInvestment - portfolioInvestment: 10049.00 - 7651.87 = 2397.13

7926 :3501: Before if - Stock counter: 0 <---> 2 <-: mindb="" nbsp="" p="">

7927 :3502: Not invested fraction %deltaPrice: 2397.13/ 10049.00 = -0.2385440

7928

7929

7930 :3192: PORTFOLIO Selected Stocks ppDB

7931 WORKSHEET 4 D[20, 7] FLOAT

7932 A B C D E F G

7933 >-------------------------------------------------<

7934 19 2569357.14 BHI 2: 38.89 38.80 38.93 39.01 38.66 38.71 37.38

7935 15 4949900.00 BOOM 17: 13.96 13.42 13.89 14.31 13.49 13.35 13.36

7936 14 3884828.57 BAC 19: 16.03 15.80 15.55 15.64 15.63 15.86 15.68

7937 19 4425657.14 BMY 20: 28.58 27.76 26.03 25.77 26.60 27.18 28.48

7938 <------------------------------------------------->

7939 1 2 3 4 5 6 7

7940

7941 :3266: NORMALIZED-SCALED Adding Up Weights: +Sum:0.67350039 -Sum: 0.00000000 +Sum - -Sum: 0.67350039

7942 :3275: end normalizar el output °°° Adding Up Weights sum: 0.00000000 +Sum:0.67350039

7943 -Sum: 0.00000000 +Sum - -Sum: 0.67350039 last col W, previous N

7944

7945

7946 :3192: PORTFOLIO Selected Stocks ppDB

7947 WORKSHEET 4 D[27, 7] FLOAT

7948 A B C D E F G

7949 >-------------------------------------------------<

7950 22 6377114.29 BHI 2: 39.01 38.66 38.71 37.38 38.69 38.97 38.16

7951 17 7204742.86 BAC 19: 15.64 15.63 15.86 15.68 15.67 15.82 15.86

7952 19 5312757.14 ABMD 27: 13.58 13.18 12.27 12.57 12.01 10.75 11.24

7953 <------------------------------------------------->

7954 1 2 3 4 5 6 7

7955

7956 :3266: NORMALIZED-SCALED Adding Up Weights: +Sum:0.99236896 -Sum: 0.00000000 +Sum - -Sum: 0.99236896

7957 :3275: end normalizar el output °°° Adding Up Weights sum: 0.00000000 +Sum:0.99236896

7958 -Sum: 0.00000000 +Sum - -Sum: 0.99236896 last col W, previous N

7959

7960

7961 :3192: PORTFOLIO Selected Stocks ppDB

7962 WORKSHEET 4 D[27, 7] FLOAT

7963 A B C D E F G

7964 >-------------------------------------------------<

7965 22 7423414.29 BHI 2: 39.01 38.66 38.71 37.38 38.69 38.97 38.16

7966 18 7207928.57 ARAC 18: 8.79 9.04 8.88 9.01 9.19 9.20 8.65

7967 17 8251042.86 BAC 19: 15.64 15.63 15.86 15.68 15.67 15.82 15.86

7968 19 6359057.14 ABMD 27: 13.58 13.18 12.27 12.57 12.01 10.75 11.24

7969 <------------------------------------------------->

7970 1 2 3 4 5 6 7

7971

7972 :3266: NORMALIZED-SCALED Adding Up Weights: +Sum:0.99236896 -Sum: 0.00000000 +Sum - -Sum: 0.99236896

7973 :3275: end normalizar el output °°° Adding Up Weights sum: 0.00000000 +Sum:0.99236896

7974 -Sum: 0.00000000 +Sum - -Sum: 0.99236896 last col W, previous N

7975

7976

7977 :3192: PORTFOLIO Selected Stocks ppDB

7978 WORKSHEET 4 D[27, 7] FLOAT

7979 A B C D E F G

7980 >-------------------------------------------------<

7981 23 8268828.57 ASCMA 1: 15.45 16.07 16.12 16.79 16.49 16.58 16.65

7982 22 8595914.29 BHI 2: 39.01 38.66 38.71 37.38 38.69 38.97 38.16

7983 18 8887271.43 BOOM 17: 14.31 13.49 13.35 13.36 13.48 12.76 12.70

7984 18 8380428.57 ARAC 18: 8.79 9.04 8.88 9.01 9.19 9.20 8.65

7985 17 9423542.86 BAC 19: 15.64 15.63 15.86 15.68 15.67 15.82 15.86

7986 19 7531557.14 ABMD 27: 13.58 13.18 12.27 12.57 12.01 10.75 11.24

7987 <------------------------------------------------->

7988 1 2 3 4 5 6 7

7989

7990 :3266: NORMALIZED-SCALED Adding Up Weights: +Sum:0.85060483 -Sum: -0.02770535 +Sum - -Sum: 0.87831019

7991 :3275: end normalizar el output °°° Adding Up Weights sum: 0.00000000 +Sum:0.85060483

7992 -Sum: -0.02770535 +Sum - -Sum: 0.87831019 last col W, previous N

7993 :3300: -----------------------------------------------

7994 :3301: HEDGING (hdplus/hdsum) Ok! In range 0.15055000 < 0.51665508 < 0.84945000 hdplus: 0.45378342 hdminus: 0

7995 :3362: Adding Up Weights: 0.00000000 +Sum:0.85060483 -Sum: -0.02770535 +Sum - -Sum: 0.87831019 last col W

7996 :3216: run: 3 counter: 5

7997 :3454: Total number of Stocks in Portfolio db: 5 <---- nbsp=""> 2 abSum => 1.00000000 updated myInvestment: 1004

7998 :3464: w updated Portfolio, availability $myInvestment: 10049.00 minDB: 2 ppCorr

7999 WORKSHEET 8 H[27, 29] FLOAT

8000 Z AA AB AC AD

8001 >------------------------------------<

8002 1 0.00 ASCMA 1: 3271.95 196.51 16.65 0.33

8003 1 0.00 BHI 2:-1356.61 35.55 38.16 -0.14

8004 1 0.00 BOOM 17:-3183.49 250.60 12.70 -0.32

8005 1 0.00 BAC 19: 1919.87 121.03 15.86 0.19

8006 1 0.00 ABMD 27: -316.98 28.20 11.24 -0.03

8007 <------------------------------------>

8008 26 27 28 29

8009 $ n price Wi

8010 :3500: deltaPrice = myInvestment - portfolioInvestment: 10049.00 - 10048.90 = 0.10

8011 :3501: Before if - Stock counter: 5 <---> 2 <-: mindb="" nbsp="" p="">

8012 :3502: Not invested fraction %deltaPrice: 0.10/ 10049.00 = -0.0000100

8013 EXECUTE PORTFOLIO myInvestment: 10049.0000000 TickToClearPortfolio: 1000 #TicksPerStock: 33 RUN: 3

8014 R: 0.3401300 r: 0.4501300 beta: 0.0200000 %r: 2.7000000 timesLaspse: 3.0000000

8015 0.1505500 0.8494500 fabs(negSum): 0.0277054 posSum 0.8506048 Stock Counter: 5

8016 :2893: VALID PORTFOLIO initialInvestment 10048.8995100 Not invested fraction: 0.0010000% is less than 10%, OK

8017 :2904: AT THE BEGINING Remaining Stocks to beat: 5 geNSTOCKS: 0 expectedReturn: 0.2700000

8018

8019

8020

8021 :2924: Tick:-> 1 row: 17 BOOM(1) -*-*-> 12.1323350

8022 :2942: SHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 0.00 - 0.00 after discount previ

8023 :2952***: Track AbsRet = 0.00 + 143.18 = 143.18 = 0.00 + 250.60*(12.13 + -12.70) = 0.00 + 250.60 * 0.57 :2956:

8024 :2955: Portfolio Abs Ret: 143.18 retPortCurrent: 0.01 current Portfolio: 10048.90 expected retPortfolio: 0.27%

8025 :2991: Initial #SPivot is: -12.13

8026 :2967: OK current: -12.70 << > 12.13

8027

8028 :2924: Tick:-> 2 row: 19 BAC(1) -*-*-> 15.64

8029 :3135: noSHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 143.18 - 0.00 current AbsRet: 1

8030 :3145: AbsRet: 143.18 + -26.71 = 116.47 = 143.18 + 121.03 * (15.64 - 15.86) :3147: deltaPrice: -0.22 / 15.64 =

8031 :3148: Abs Ret: 116.47 retPortCurrent: 1.16% current Portfolio: 10048.90 expected retPortfolio: 0.27% overa

8032 :3162: Initial pivot val: 15.86

8033 :3164: current: 15.86 << > 15.64 #oposite direction, increases/was bad_tick_counter : 0.00 bad_tick_counter b

8034 :3128: Abrupt Opposite Jump abs retStock: 0.0141 >>> 0.0000 <- bad_tick_counter="" final="" nbsp="" p="">

8035

8036 :2924: Tick:-> 3 row: 2 BHI(1) -*-*-> 38

8037 :2942: SHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 116.47 - 0.00 after discount pre

8038 :2952***: Track AbsRet = 116.47 + -9.97 = 106.50 = 116.47 + 35.55*(38.44 + -38.16) = 116.47 + 35.55 * -0.28 :2

8039 :2955: Portfolio Abs Ret: 106.50 retPortCurrent: 0.01 current Portfolio: 10048.90 expected retPortfolio: 0.27%

8040 :2991: Initial #SPivot is: -38.16

8041 :2967: OK current: -38.16 << > 38.44 :2971: #going up -oposite direction-, increase/was bad_tick_counter was:

8042 :2976***: verify Abrupt Jump in price -going up- retStock: -0.0073 >>> 0.0000 <- bad_ti="" nbsp="" now="" p="">

8043

8044 :2924: Tick:-> 4 row: 17 BOOM(2) -*-*-> 12.0371

8045 :2942: SHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 106.50 - 143.18 after discount p

8046 :2952***: Track AbsRet = -36.69 + 167.05 = 130.36 = -36.69 + 250.60*(12.04 + -12.70) = -36.69 + 250.60 * 0.67

8047 :2955: Portfolio Abs Ret: 130.36 retPortCurrent: 0.01 current Portfolio: 10048.90 expected retPortfolio: 0.27%

8048 :3004: pivot val now is: -12.04

8049 :3014: #No change -remains in ZERO- in badTickerCounter: 0.00

8050

8051 :2924: Tick:-> 5 row: 2 BHI(2) -*-*-> 38.93

8052 :2942: SHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 130.36 - -9.97 after discount pr

8053 :2952***: Track AbsRet = 140.34 + -27.31 = 113.03 = 140.34 + 35.55*(38.93 + -38.16) = 140.34 + 35.55 * -0.77 :

8054 :2955: Portfolio Abs Ret: 113.03 retPortCurrent: 0.01 current Portfolio: 10048.90 expected retPortfolio: 0.27%

8055 :2983: opposite direction to short, ticker counter was: 2 :2985: becomes: 3 no change in pivot: -38.16

8056 :2986: greather than previous val #current: 38.93 > 38.44 increases bad_tick_counter: 3.00 :2987: NO change i

8057 :2991***: Abrupt Jump respect Pivot - real Strock ret: 0.00

8058 :2990: datum: 38.93 rStockPivot = (38.93 - 38.16) / 38.16 = 0.02 >>> 0.00 negative return is bigger than 0.

8059 :2992: Bad Tick counter was: 3.00 becomes: 4.00

8060 :3031: #Short! -stock leaves- Portfolio expectedReturn 0.0027 meanRealReturnStock: 0.0000

8061

8062 :2924: Tick:-> 6 row: 1 ASCMA(1) -*-*-> 16.5300

8063 :3135: noSHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 113.03 - 0.00 current AbsRet: 1

8064 :3145: AbsRet: 113.03 + -23.58 = 89.45 = 113.03 + 196.51 * (16.53 - 16.65) :3147: deltaPrice: -0.12 / 16.53 =

8065 :3148: Abs Ret: 89.45 retPortCurrent: 1.03% current Portfolio: 8692.29 expected retPortfolio: 0.27% overall

8066 :3162: Initial pivot val: 16.65

8067 :3164: current: 16.65 << > 16.53 #oposite direction, increases/was bad_tick_counter : 0.00 bad_tick_counter b

8068 :3128: Abrupt Opposite Jump abs retStock: 0.0073 >>> 0.0000 <- bad_tick_counter="" final="" nbsp="" p="">

8069

8070 :2924: Tick:-> 7 row: 19 BAC(2) -*-*-> 16

8071 :3135: noSHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 89.45 - -26.71 current AbsRet:

8072 :3145: AbsRet: 116.16 + 23.23 = 139.39 = 116.16 + 121.03 * (16.05 - 15.86) :3147: deltaPrice: 0.19 / 16.05 = 0

8073 :3148: Abs Ret: 139.39 retPortCurrent: 1.60% current Portfolio: 8692.29 expected retPortfolio: 0.27% overal

8074 :3857: pivot val now is: 16.05

8075 :3863: #Good Direction, this data greather than previous, discount Bad hit counter: 1.00

8076

8077 :2924: Tick:-> 8 row: 27 ABMD(1) -*-*-> 11.51

8078 :2942: SHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 139.39 - 0.00 after discount pre

8079 :2952***: Track AbsRet = 139.39 + -7.61 = 131.77 = 139.39 + 28.20*(11.51 + -11.24) = 139.39 + 28.20 * -0.27 :2

8080 :2955: Portfolio Abs Ret: 131.77 retPortCurrent: 0.02 current Portfolio: 8692.29 expected retPortfolio: 0.27%

8081 :2991: Initial #SPivot is: -11.24

8082 :2967: OK current: -11.24 << > 11.51 :2971: #going up -oposite direction-, increase/was bad_tick_counter was:

8083 :2976***: verify Abrupt Jump in price -going up- retStock: -0.0235 >>> 0.0000 <- bad_ti="" nbsp="" now="" p="">

8084

8085 :2924: Tick:-> 9 row: 17 BOOM(3) -*-*-> 11.8562

8086 :2942: SHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 131.77 - 167.05 after discount p

8087 :2952***: Track AbsRet = -35.28 + 212.39 = 177.12 = -35.28 + 250.60*(11.86 + -12.70) = -35.28 + 250.60 * 0.85

8088 :2955: Portfolio Abs Ret: 177.12 retPortCurrent: 0.02 current Portfolio: 8692.29 expected retPortfolio: 0.27%

8089 :3004: pivot val now is: -11.86

8090 :3014: #No change -remains in ZERO- in badTickerCounter: 0.00

8091

8092 :2924: Tick:-> 11 row: 1 ASCMA(2) -*-*-> 16.45

8093 :3135: noSHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 177.12 - -23.58 current AbsRet:

8094 :3145: AbsRet: 200.70 + -39.30 = 161.40 = 200.70 + 196.51 * (16.45 - 16.65) :3147: deltaPrice: -0.20 / 16.45 =

8095 :3148: Abs Ret: 161.40 retPortCurrent: 1.86% current Portfolio: 8692.29 expected retPortfolio: 0.27% overal

8096 :3184: opposite direction, ticker counter was: 2 :3186: becomes: 3

8097 :3187: #current 16.45 < 16.53 <--:less bad_tick_counter:="" change="" in="" nbsp="" no="" p="" pivot:="" previous="" than="">

8098 :3193: Abrupt Jump respect Pivot, assetRet: 0.00 datum: 16.45 rStockPivot = (16.45 - 16.65) / 16.65 = -0.01

8099 :3196: bad_tick_counter was: 3 :3199: becomes: 4

8100 :3884: Clear this stock -badTick reached the limit: 3 -1

8101

8102 :2924: Tick:-> 12 row: 27 ABMD(2) -*-*-> 14

8103 :2942: SHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 161.40 - -7.61 after discount pr

8104 :2952***: Track AbsRet = 169.01 + -70.22 = 98.79 = 169.01 + 28.20*(13.73 + -11.24) = 169.01 + 28.20 * -2.49 :2

8105 :2955: Portfolio Abs Ret: 98.79 retPortCurrent: 0.02 current Portfolio: 5420.34 expected retPortfolio: 0.27%

8106 :2983: opposite direction to short, ticker counter was: 2 :2985: becomes: 3 no change in pivot: -11.24

8107 :2986: greather than previous val #current: 13.73 > 11.51 increases bad_tick_counter: 3.00 :2987: NO change i

8108 :2991***: Abrupt Jump respect Pivot - real Strock ret: 0.00

8109 :2990: datum: 13.73 rStockPivot = (13.73 - 11.24) / 11.24 = 0.22 >>> 0.00 negative return is bigger than 0.

8110 :2992: Bad Tick counter was: 3.00 becomes: 4.00

8111 :3031: #Short! -stock leaves- Portfolio expectedReturn 0.0027 meanRealReturnStock: 0.0000

8112

8113 :2924: Tick:-> 15 row: 19 BAC(3) -*-*-> 16.5631

8114 :3135: noSHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 98.79 - 23.23 current AbsRet: 7

8115 :3145: AbsRet: 75.56 + 84.82 = 160.38 = 75.56 + 121.03 * (16.56 - 15.86) :3147: deltaPrice: 0.70 / 16.56 = 0.0

8116 :3148: Abs Ret: 160.38 retPortCurrent: 3.14% current Portfolio: 5103.36 expected retPortfolio: 0.27% overal

8117 :3857: pivot val now is: 16.56

8118 :3863: #Good Direction, this data greather than previous, discount Bad hit counter: 0.00

8119

8120 :2924: Tick:-> 17 row: 19 BAC(4) -*-*-> 16.66

8121 :3135: noSHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 160.38 - 84.82 current AbsRet:

8122 :3145: AbsRet: 75.56 + 96.44 = 172.00 = 75.56 + 121.03 * (16.66 - 15.86) :3147: deltaPrice: 0.80 / 16.66 = 0.0

8123 :3148: Abs Ret: 172.00 retPortCurrent: 3.37% current Portfolio: 5103.36 expected retPortfolio: 0.27% overal

8124 :3857: pivot val now is: 16.66 :3866: #No change -remains in ZERO- in badTickerCounter: 0.00

8125

8126 :2924: Tick:-> 18 row: 19 BAC(5) -*-*-> 16.64

8127 :3135: noSHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 172.00 - 96.44 current AbsRet:

8128 :3145: AbsRet: 75.56 + 94.12 = 169.68 = 75.56 + 121.03 * (16.64 - 15.86) :3147: deltaPrice: 0.78 / 16.64 = 0.0

8129 :3148: Abs Ret: 169.68 retPortCurrent: 3.32% current Portfolio: 5103.36 expected retPortfolio: 0.27% overal

8130 :3184: opposite direction, ticker counter was: 0 :3186: becomes: 1

8131 :3187: #current 16.64 < 16.66 <--:less bad_tick_counter:="" change="" in="" nbsp="" no="" p="" pivot:="" previous="" than="">

8132 :3193: Abrupt Jump respect Pivot, assetRet: 0.00 datum: 16.64 rStockPivot = (16.64 - 16.66) / 16.66 = -0.00

8133 :3196: bad_tick_counter was: 1 :3199: becomes: 2

8134

8135 :2924: Tick:-> 19 row: 17 BOOM(4) -*-*-> 12

8136 :2942: SHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 169.68 - 212.39 after discount p

8137 :2952***: Track AbsRet = -42.71 + 69.21 = 26.49 = -42.71 + 250.60*(12.43 + -12.70) = -42.71 + 250.60 * 0.28 :2

8138 :2955: Portfolio Abs Ret: 26.49 retPortCurrent: 0.01 current Portfolio: 5103.36 expected retPortfolio: 0.27%

8139 :2983: opposite direction to short, ticker counter was: 0 :2985: becomes: 1 no change in pivot: -11.86

8140 :2986: greather than previous val #current: 12.43 > 11.86 increases bad_tick_counter: 1.00 :2987: NO change i

8141 :2991***: Abrupt Jump respect Pivot - real Strock ret: 0.00

8142 :2990: datum: 12.43 rStockPivot = (12.43 - 11.86) / 11.86 = 0.05 >>> 0.00 negative return is bigger than 0.

8143 :2992: Bad Tick counter was: 1.00 becomes: 2.00

8144

8145 :2924: Tick:-> 20 row: 19 BAC(6) -*-*-> 16.77

8146 :3135: noSHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 26.49 - 94.12 current AbsRet: -

8147 :3145: AbsRet: -67.63 + 110.39 = 42.76 = -67.63 + 121.03 * (16.77 - 15.86) :3147: deltaPrice: 0.91 / 16.77 = 0

8148 :3148: Abs Ret: 42.76 retPortCurrent: 0.84% current Portfolio: 5103.36 expected retPortfolio: 0.27% overall

8149 :3857: pivot val now is: 16.77

8150 :3863: #Good Direction, this data greather than previous, discount Bad hit counter: 1.00

8151

8152 :2924: Tick:-> 21 row: 19 BAC(7) -*-*-> 16.58

8153 :3135: noSHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 42.76 - 110.39 current AbsRet:

8154 :3145: AbsRet: -67.63 + 87.15 = 19.52 = -67.63 + 121.03 * (16.58 - 15.86) :3147: deltaPrice: 0.72 / 16.58 = 0.

8155 :3148: Abs Ret: 19.52 retPortCurrent: 0.38% current Portfolio: 5103.36 expected retPortfolio: 0.27% overall

8156 :3184: opposite direction, ticker counter was: 1 :3186: becomes: 2

8157 :3187: #current 16.58 < 16.77 <--:less bad_tick_counter:="" change="" in="" nbsp="" no="" p="" pivot:="" previous="" than="">

8158 :3193: Abrupt Jump respect Pivot, assetRet: 0.00 datum: 16.58 rStockPivot = (16.58 - 16.77) / 16.77 = -0.01

8159 :3196: bad_tick_counter was: 2 :3199: becomes: 3

8160 :3884: Clear this stock -badTick reached the limit: 3 1

8161

8162 :2924: Tick:-> 22 row: 17 BOOM(5) -*-*-> 13

8163 :2942: SHORT assetRet: 0.00 from previous tick discount previous AbsRet-> 19.52 - 69.21 after discount pre

8164 :2952***: Track AbsRet = -49.68 + -14.32 = -64.00 = -49.68 + 250.60*(12.76 + -12.70) = -49.68 + 250.60 * -0.06

8165 :2955: Portfolio Abs Ret: -64.00 retPortCurrent: -0.02 current Portfolio: 3183.49 expected retPortfolio: 0.27%

8166 :2983: opposite direction to short, ticker counter was: 2 :2985: becomes: 3 no change in pivot: -11.86

8167 :2986: greather than previous val #current: 12.76 > 12.43 increases bad_tick_counter: 3.00 :2987: NO change i

8168 :2991***: Abrupt Jump respect Pivot - real Strock ret: 0.00

8169 :2990: datum: 12.76 rStockPivot = (12.76 - 11.86) / 11.86 = 0.08 >>> 0.00 negative return is bigger than 0.

8170 :2992: Bad Tick counter was: 3.00 becomes: 4.00

8171 :3031: #Short! -stock leaves- Portfolio expectedReturn 0.0027 meanRealReturnStock: 0.0000

8172 :3390: AT THE END Remaining Stocks to beat: 0 geNSTOCKS: 1002 expectedReturn: 0.2700

8173

8174 :3392: RUN 3 COL 7 Portfolio remaining after closing position pre-Final Portfolio Report ppDataIn

8175 WORKSHEET 9 I[27, 9] FLOAT

8176 A B C D E F G H I

8177 >---------------------------------------------------------------<

8178 3 4.00 ASCMA 1: 16.65 16.45 -0.20 -1.20 -39.30 -0.45 8692.29 196.51 -1.00

8179 3 4.00 BHI 2: -38.16 38.93 -0.77 -2.01 -27.31 -0.27 10048.90 35.55 -1.00

8180 6 4.00 BOOM 17: -12.70 12.76 -0.06 -0.45 -14.32 -0.45 3183.49 250.60 -1.00

8181 8 3.00 BAC 19: 15.86 16.58 0.72 4.54 87.15 1.71 5103.36 121.03 1.00

8182 3 4.00 ABMD 27: -11.24 13.73 -2.49 -22.15 -70.22 -1.30 5420.34 28.20 -1.00

8183 <--------------------------------------------------------------->

8184 1 2 3 4 5 6 7 8 9

8185 nTick badTicks Vo Vf d %r R=(Vf-Vo)*n %R Portf nhit/miss

8186 :3394: geNSTOCKS:-> 1002 <--->1000 <-:genstockslimit p="">

8187 :3395: *****Abs Ret: -64.00 al final SHUT DOWN Portfolio because overflow of allowed ticks? :3397: Portfolio

8188 :3503: NOTHING TO CLEAR --- all stocks processed

8189 :3559: ok dbDataSumOnRowCol 5 RETURN $: -64.00 %R = -64.00 / 10048.90 = -0.64% compare with last AbsRet: -64

8190 :3560: Transaction costs tc * nStocks 5*0.00 = 0.00

8191 :3551: Transaction costs tshort * nStocks 2*0.00 = 0.00

8192 :3562: Net Return -64.00 - 0.00 - 0.00 = -64.00

8193 :3464: Net Return -64.00

8194 :4012: NOT GOOD PORTFOLIO, KEEP PREVIOUS INVESTMENT 9984.00

8195 :4107: next investment ok dbDataSumOnRowCol 10032.00

8196 counter: 5 Total Ticks: 1002 Mean Tick: 200

8197

8198 :4256: Starts a New Round, run: 2 reset geNSTOCKS: 99999

8199 :3822: minDB: 1507.35 stTo = 0.45 * myInvestment / minDB : 4522.05 / 3 V

8200 :3834: ??????CLOSES if (!(posSum > 7. || fabs(negSum) > 7.) && counter > 1) {

8201

8202

16521 hft_0724 Elapsed Time: 29 sec CHRONO START: Sat Jun 24 10:07:24 2023

16522 STOP: Sat Jun 24 10:07:53 2023

16523

16524

16525 Boost version: 1.82.0

16526

16527 EXIT FROM EXSAN

| Low Latency Systematic Trading Algorithm |

| Previous Post | Next Post |

|---|

Comments

Post a Comment