HFT - Low Latency Trading - How to correlate at tick by tick level (miliseconds)

This is an ideal scenario that is not realist

It is assumed that events have occured at the same relative time. Entry number 3 the values 15.6 353 134 57.19 are assumed to occured at the same time

High Frequency Trading, events are stochastic in time, this is much more realistic

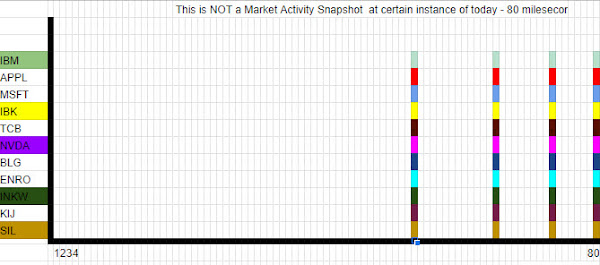

1 The image above is the snapshot of those stocks active during the last 80

2 milisenconds at certain instant of the day(active market hours).

3 Covariance matrix is used to determine the relationship between the movements

4 of stocks. When stocks tend to move together, they are seen as having a

5 positive covariance; when they move inversely, the covariance is negative.

6 Is it possible to calculate the INSTANT covariance matrix in HFT?

7 How to select compatible stocks to create an instant covariance matrix?

8 Hedging uses covariance matrix to calculate correlations.

9 Portfolio theory uses covariance; is it possible to create a

10 Portfolio of Markowitz in HFT (Low Latency Trading) ?

11 The goal is to use only the available data, there is no missing data.

12 The algorithm should identify which entries(stocks) can be correlated.

13 The whole ExSan layout is updated with tick by tick stock data market.

14 There are entries (stocks)very active, others not so active and others

15 idle, all this in terms of HFT - Low Latency Trading, ie. activity in the

16 recent milliseconds

17 ExSan can handle +1000 time series(stocks).

| Previous | Low Latency Systematic Trading Algorithm | Next |

Comments

Post a Comment