HFT - Low Latency Trading - How to correlate at tick by tick level (miliseconds)

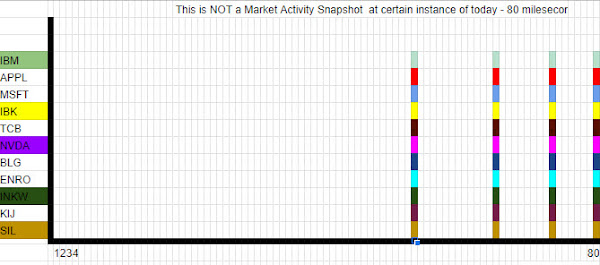

ExSan++ This is an ideal scenario that is not realist It is assumed that events have occured at the same relative time. Entry number 3 the values 15.6 353 134 57.19 are assumed to occured at the same time High Frequency Trading, events are stochastic in time, this is much more realistic 1 The image above is the snapshot of those stocks active during the last 80 2 milisenconds at certain instant of the day(active market hours). 3 Covariance matrix is used to determine the relationship between the movements 4 of stocks. When stocks tend to move together, they are seen as having a ...